How to plan for your dream retirement

Retirement: that long-awaited permanent holiday phase of life where you can relax, unwind and fill your years with special memories. You will have earnt it! But to get there and live the retirement of your dreams, you need to invest a little time and energy into planning for your future. Trust us, it will be worth it! The earlier you start planning, the more you will be able to seize the incredible opportunities that retirement offers - even if right now, it all seems so far away.

Whether you’re 28 or 58, you can always benefit from looking ahead and crunching some numbers. You don’t need to be an accounting genius either! Start by checking out the following tips on how you can begin to slay your financial goals and get yourself set up for the retirement you deserve.

How much should I aim to have saved for retirement?

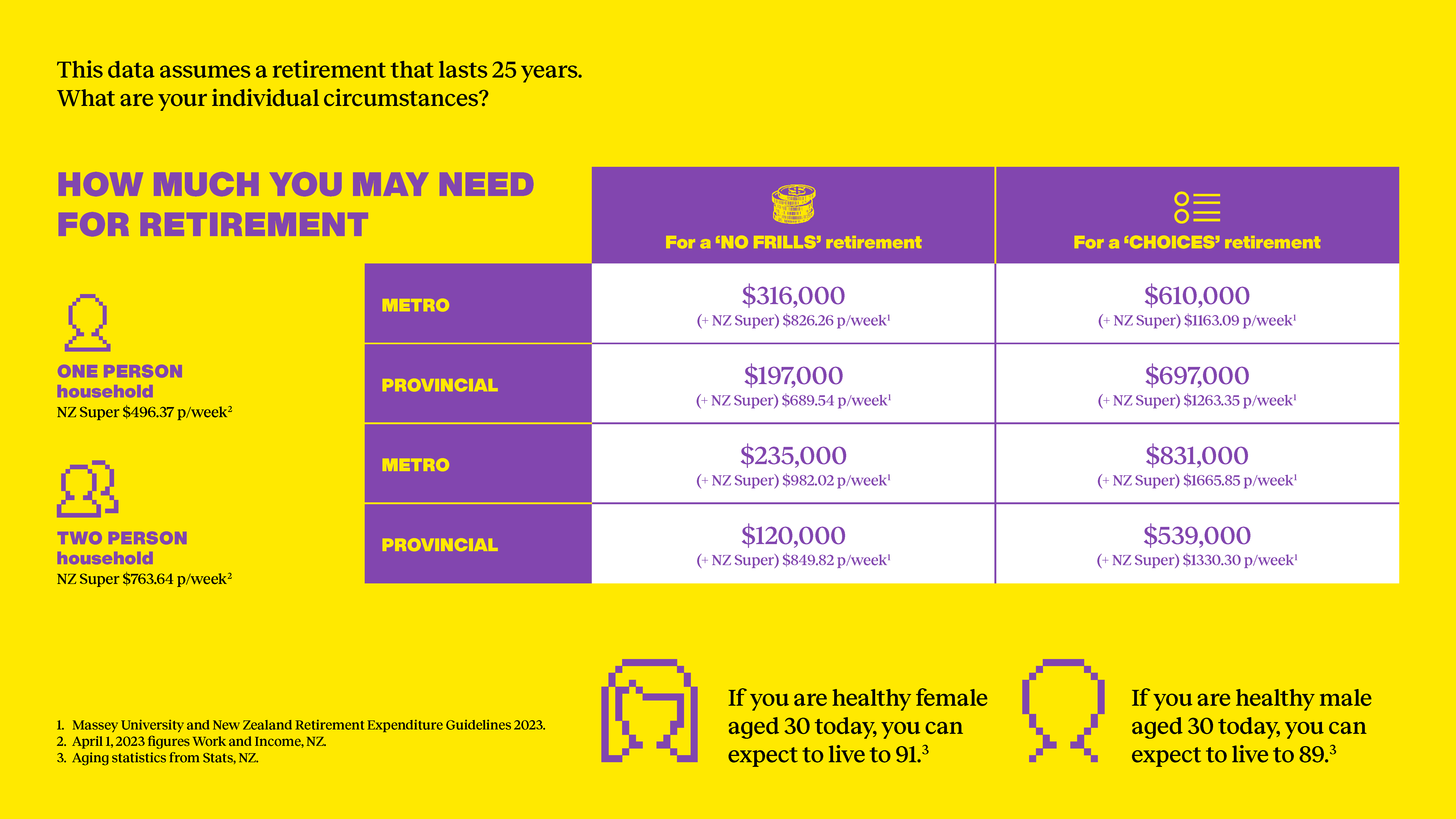

This is the golden question - and there is no one perfect answer! However, taking a peek at the table below might help you envision the level of savings needed for a comfortable retirement.

The Massey University New Zealand Retirement Expenditure Guidelines have provided the basis for this table.

There are two different categories pictured - “no frills” and “choices” retirements. You’ll see that there is quite a difference between the sums required for each - but don’t let that intimidate you! For a retirement where you can enjoy some luxuries like overseas holidays, you’ll want to aim for the “choices” option. It might take a little bit more work in the beginning - but it will be so worth it when you can treat yourself, right?

Why is planning for retirement so important?

Whether you end up retiring as a couple or solo, it’s vital you get amongst the retirement planning process. Why? Think of it as another frontier where you can embrace your independence and take control of not only your finances but also your whole future. That’s powerful stuff.

Despite significant progress being made, the gender pay gap is still an ongoing challenge in today's world. Savvy retirement planning can help you bridge this gap. Investing wisely, maximising your income potential, and making informed financial decisions can help you level the playing field and chart a new path.

Also, don’t forget: in general, women have a longer life expectancy than men! Sorry lads - but this gift of longevity means us ladies tend to have a bit more time to enjoy our passions throughout retirement. That extra time, however, means a little bit more planning is on the cards. By getting started with saving and investing early, we can confidently embrace a longer life filled with joy, purpose and security. Now that’s some valuable peace of mind.

How can I prepare my finances for retirement?

If you haven’t already enrolled in KiwiSaver, now is the time! When you enter the KiwiSaver scheme, you can choose to contribute 3%, 4%, 6%, 8% or 10% of your pay into your retirement fund.

Joining KiwiSaver makes retirement saving so simple. Your contributions will automatically be moved out of your pay and into your KiwiSaver account, so you won’t even think about it or notice it’s gone! Plus, in addition to using it for retirement, you can also withdraw these funds to purchase your first home.

You can contact a Mercer financial adviser here to talk all things KiwiSaver. We also recommend you speak to one of the team before or straight after you switch your KiwiSaver investment to Mercer. They can help you figure out how much your unique retirement goals may require - and how to get there.

Let’s turn societal expectations on their heads - no matter if you take time off traditional work to perform a caregiver role or climb the career ladder right to the top, you can plan for an incredible and fulfilling retirement. The possibilities are so exciting!

The final word

Don’t think of financial retirement planning as just an option - it’s a necessity. Jump on board this empowering journey towards securing your independence and shaping your financial destiny. By taking control of your money and planning for the future, you can break barriers, narrow the gender pay gap, and build a brighter, more secure world for yourself - and others.

Want to help empower other gals in your life to do the same? Share this article with your whanau and friends to help foster more financial wellbeing for women. Together, we can make it happen.

The above article is general information and does not purport to give financial advice. The Mercer KiwiSaver scheme and Mercer FlexiSaver are issued by Mercer (N.Z.) Limited. Product Disclosure Statements are available free of charge at seatatthetable.co.nz.