Compound interest: What is it and how does it work?

Start saving early and reap the financial rewards of compound interest.

Compound interest is your new best friend. Why? Simply put, it’s the interest you earn on interest (as well as the interest you earn on your capital). It’s the way to grow your wealth and help you become financially independent.

In fact, it’s so great that Albert Einstein apparently once described compound interest as the “eighth wonder of the world,” saying: “he who understands it, earns it; he who doesn't, pays for it.”

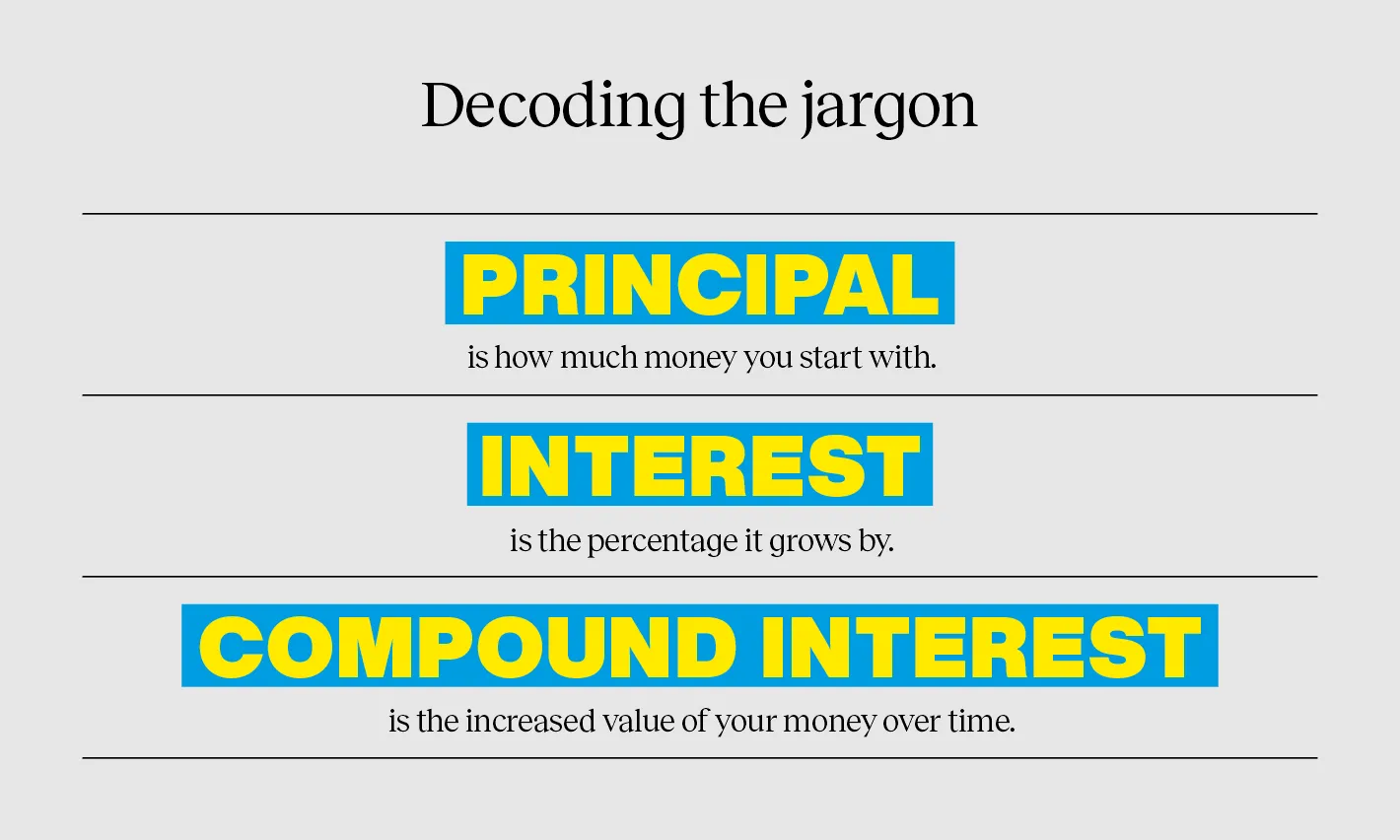

Still confused? We know, it can be a lot, but let us explain.

How compound interest works with savings

Think of a snowball: as it rolls along in the snow, it gets bigger and bigger. This is also what happens with compound interest.

Take Maia, for example: Maia has $10,000 in a savings account with 4% interest which she leaves untouched in her account. At the end of year one, she’ll have earned $400 in interest giving her a total of $10,400. Every year, that interest will “snowball”, so that after 30 years, she’ll have earned $22,434 in interest giving her a total of $32,434. Not bad for an initial $10,000 investment, right? This is assuming Maia has made no withdrawals and the 4% interest rate has remained steady.

Tess, on the other hand, takes a different approach. She also has $10,000 in a savings account with 4% interest, but instead of leaving it there like Maia does, she takes out the interest she earns each year to buy cool new stuff. That means that every year, Tess will have an extra $400 to spend on whatever she likes. But unlike Maia, whose savings will have ballooned after 30 years thanks to compound interest, Tess would have spent $12,000 over the years and she would still have $10,000 in her account.

Now think about your KiwiSaver account or your investment portfolio and the thousands of dollars that many of us will invest into it over the next 40 or so years of our working lives. By taking the same approach as Maia does, compound interest means that it all adds up, potentially leaving us with a pretty sizable snowball in the years to come.

“The most important thing to remember about compound interest is the earlier you start the greater the return is to you,” says Glenys Wilson, head of the financial advice team at Mercer.

“For example, if you're in your early 20s and in your first job, starting early with a small regular amount will earn you significantly more than if you start much later in life with much bigger contributions.”

“I knew a woman in her 60s who’d been a cleaner all of her life on a low wage. But she’d been consistent and had made sure she was in the right fund and steadily made regular contributions from her 20s in addition to contributions from her employer. At retirement, when I told her she had over $800,000 in her investment account, she nearly fell off her chair.”

How it works with debt

Understanding compound interest is also important when it comes to debt. Paying back debt as quickly as possible is crucial because the rules of compound interest also apply.

For example, Jessie has $1,000 in credit card debt which charges 12.9% in interest every year. After 10 years of failing to pay this money back, Jessie’s debt will have ballooned to $3,364.65 – more than three times the original amount that she borrowed.

So the slower you repay debt which charges interest, the more you’ll end up paying back over time. And if you’re struggling with debt and are looking for tips and resources on how to better manage it, check out our guide on dealing with debt here.

What you can do today

Whether you’re investing towards a goal or paying off a loan, the principles of compound interest mean that starting early can make a huge difference. If you haven’t got your KiwiSaver sorted, start contributing now. And if you’ve got money sitting idly in a bank account, think about setting up an investment account instead. All these things add up over time, and by starting now, your future self will thank you for it later.

Tools

- Retirement Simulator here

- Compound Interest Calculator here

- Listen to the KiwiSaver podcast and the investment podcast

The above article is general information and does not purport to give financial advice. The Mercer KiwiSaver scheme and Mercer FlexiSaver are issued by Mercer (N.Z.) Limited. Product Disclosure Statements are available free of charge at seatatthetable.co.nz.